How do I qualify for the student loan forgiveness program?

9 in-depth ways to pay up your student’s loan with or without the forgiveness program.

Table of contents

6 Types of Forgiveness, Cancellation, and Discharge

Public Service Loan Forgiveness

Perkins Loan Cancellation and Discharge

3 Guaranteed ways to pay up your loan by yourself in less than 5 years while still saving up.

Find a high-paying job and be financially disciplined

Create a strong and diverse investment portfolio

News just in; President Joe Biden announced on Wednesday that his administration would cancel $10,000 in federal student loans for most borrowers, fulfilling his campaign promise to help millions of Americans with student loan debt.

Borrowers earning less than $125,000 per year for individuals and less than $250,000 for married couples or heads of households are eligible for the plan. Pell Grant recipients who meet the income requirements are also included in the plan and are eligible for up to $20,000 in relief. Holders of private loans are not eligible for relief.

There hasn't been much detail on how borrowers may determine if they're eligible for the debt relief and what the application will include, however, the release mentioned that an application for borrowers to apply for the program would be available "in the coming weeks".

However, the release states that over 8 million borrowers should be qualified to get debt relief immediately. The Department of Education possesses income information for these borrowers.

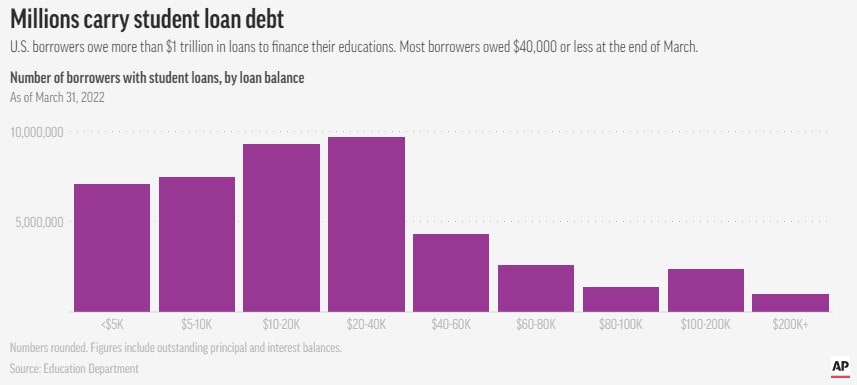

With this news confirmed, it will significantly reduce the amount of loans owed by millions of people. The average amount owed by each borrower is $28,950, therefore with this loan, 56% of borrowers will only have to finish and pay off half of their initial debt, leaving approximately 20% of borrowers debt-free

Federal student debt in the US has risen steadily for years and currently exceeds $1.6 trillion. According to the most recent federal figures, more than 43 million Americans have federal student debt, with roughly a third owing less than $10,000 and more than half owing less than $20,000.

Just days before millions of Americans were expected to learn when their upcoming student loan bills were due, the pandemic-era payment moratorium was extended. With the current pause scheduled to conclude on August 31, this is the closest the administration has been to the end of the payment freeze extension.

As of August 19, 2022, the statistics above were accurate.

9 in-depth ways to pay up your student’s loan with or without the forgiveness program.

Now, before we dive into it, there are no official instructions from the US department of education loan forgiveness program as of yet.

But we assume from the statement released that every student in the United States will see their loan completed eliminated or at least by half, this is meant to be the default but we all know politicians and how they can twist things into a complicated mess, with this “good news” will come with a series of requirements that will qualify you to be applicable for the loan.

So this is what we know for now

How can I check if I qualify for student loan forgiveness?

1. Check your 2020 and 2021 tax returns to make sure you fulfill the income requirement. According to experts, the government will probably estimate your yearly income from one or both of those forms.

2. By entering into your Free Application for Federal Student Aid (FAFSA) account using your FSA ID, see if you are a Pell Grant recipient and qualify for further aid. Your student aid report (SAR), which lists all of the financial aid awards you have earned, including any Pell Grants, should be available on the portal. The financial assistance award letter you received from the school you attended also contains this information.

Check your communication preferences on your FAFSA and loan servicer accounts so you know where, and how, these agencies will contact you about receiving debt relief.

The benefits of student loan forgiveness are endless and can help drive the economy in more ways than one due to how loans and debt affect our mental approach to our daily living.

In addition to this potential, wide-sweeping loan forgiveness, there are also student loan forgiveness programs already in place for borrowers who meet certain employment and payment criteria, and these are the ones I will be focusing on.

The caveat is that most of these programs are funded by the federal government and only apply to federal loans. There are also strict qualifications - such as your occupation, specific student loan plan, military status, and more - if you want to have any portion of your loans cleared. Check out the student loan forgiveness programs listed below to see if you qualify.

If you have private student loans, there are other options available to you in order to alleviate some of the financial strain student loan debt may be causing you. Check out various student loan lenders to see what kind of terms, rates and offers they have.

6 Types of Forgiveness, Cancellation, and Discharge

The summaries below provide a quick overview of the various types of forgiveness, cancellation, and discharge available for federal student loans.

1. Public Service Loan Forgiveness

Under the Public Service Loan Forgiveness (PSLF) Program, you may be eligible for loan forgiveness if you work for the government or a non-profit.

After you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for an eligible company, PSLF forgives the remaining debt on your Direct Loans.

Applying for PSLF, Steps for all of the following, use the PSLF Help Tool:

1. Find out if your employer is eligible.

2. Every year, verify your employment.

3. Once you've completed everything, submit an application for forgiveness.

4. Create your PSLF form and send it to the PSLF servicer with your signature on it.

Tips: As you go toward PSLF, certify your employment annually. When you're prepared to ask for forgiveness in the future, doing that will save you time and work.

Find out more about the PSLF Program to determine if you might be eligible.

2. Teacher Loan Forgiveness

Your Direct Loan or FFEL Program loans could be forgiven up to $17,500 if you work five full academic years as a full-time teacher in a low-income elementary school, secondary school, or organization that provides educational services.

What conditions must be met to be eligible?

• As of October 1, 1998, or on the date you got a Direct Loan or FFEL Program loan after October 1, 1998, you cannot have an outstanding debt on any Direct Loans or Federal Family Education Loan (FFEL) Program loans.

• You must have worked as a highly qualified full-time teacher for five complete academic years in a row, with at least one of those years occurring after the 1997–98 school year.

• You must have worked at an elementary school, secondary school, or organization that provides educational services to students from low-income households (a "low-income school or educational service agency").

• Before the completion of your five academic years of acceptable teaching service, the loan(s) for which you are asking for forgiveness must have been taken out.

Find out more about the Teacher Loan Forgiveness Program's qualifications and application process.

3. Perkins Loan Cancellation and Discharge

Based on your career or volunteer work, you might be qualified to have all or some of your Perkins Loan forgiven (under certain conditions). This includes the cancellation of Perkins Loan Teachers.

What qualifications are needed to be eligible?

• If you have worked full time as a teacher in a public or nonprofit elementary or secondary school system, you are eligible for cancellation of up to 100% of a Federal Perkins Loan.

• Teacher at a school for children from low-income families;

• A special education teacher, such as a teacher of young children, adolescents, or newborns with impairments; or

• A math, science, foreign language, or bilingual education teacher, or in any other area of specialization if there is a dearth of qualified teachers in that state as recognized by a state education agency.

4. Closed School Discharge

If your school closes while you’re enrolled or soon after you withdraw, you may be eligible for discharge of your federal student loan.

Loan Discharge Standards

If your school closed and you couldn't finish your program, you might be qualified for a full discharge of your William D. Ford Federal Direct Loan (Direct Loan) Program, Federal Family Education Loan (FFEL) Program, or Federal Perkins Loans.

• You were enrolled when your school closed;

• When your school closed, you were on a permissible leave of absence;

• If your loans were initially disbursed before July 1, 2020, your school closed within 120 days of your withdrawal; or

• If your loans were first disbursed on or after July 1, 2020, your school closed within 180 days of your withdrawal.

Find out if you qualify for a closed school discharge and how to submit an application.

5. Borrower Defense to Repayment

If you took out the loans to attend a school and the school did something or failed to do something connected to your loan or to the educational services that the loan was intended to pay for, you may be eligible for a discharge of your federal student loans based on the borrower defense to repayment. Depending on when you obtained your loan, there are different prerequisites for a borrower defense to repayment discharge.

Who is eligible?

Borrowers with federal student loans who:

• Attended a school that you believe deceived you or engaged in other misconduct,

• Or can demonstrate that the school violated state law in connection with your loan or the educational services provided.

Learn about the borrower defense to repayment procedure, prerequisites, and application procedures.

6. Unpaid Refund Discharge

If you withdrew from school and the school didn’t make a required return of loan funds to the loan servicer, you might be eligible for a discharge of the portion of your federal student loan(s) that the school failed to return.

How do I apply for a discharge of unpaid refunds?

If the school you attended is still in operation, you should contact it and try to resolve the issue with them before filing for an unpaid refund discharge. If your school has closed, you should first see if you are eligible for a closed school discharge instead. For more information, contact your loan servicer. Log in to "My Federal Student Aid" to find out who your loan servicer is.

If you're ready to apply for the unpaid refund discharge, fill out the Loan Discharge ApplicationUnpaid Refund and send it to your loan servicer.

Find out more about the unpaid refund discharge and see if you qualify.

3 Guaranteed ways to pay up your student's loan in less than 5 years while saving.

What if all the above doesn’t work, you followed the rules and did everything they said and you are still left with a mountain of debt. I can already feel how disappointed you will be especially after I have given you hope from my list above.

Well there are other ways but they will take more work and dedication, if you can follow the pieces of advice below and integrate them into your financial decisions then you will get to pay up that student’s loan fast, guaranteed. Let’s jump in;

1. Find a high-paying job and be financially disciplined

If you have student loan debt, you should have a degree or specialized training to show for it. This should enable you to obtain a higher-paying job than you would have been able to obtain without the additional education or training. Put that extra income toward paying off your student loans.

I recommend that you list all of your loans, as well as the minimum payments and interest rate. Sort this list from highest to lowest interest debt.

Every month, make the minimum payment on all of your loans on time. Then, any remaining funds should be applied to the loan with the highest interest rate. Once that loan is paid off, move on to the next, and so on.

Debt repayment necessitates discipline. It entails giving up everything you don't absolutely need. Pay your rent, groceries, utilities, and the bare minimum for transportation.

Drive a used car or take the bus; share a room; avoid eating out; avoid coffee shop drinks and snacks; pack your lunch every day. You'd be surprised how much cash flow you can free up each month if you don't waste money. Make getting out of debt your top priority, and it will happen.

You can check out our post on 7 practical ways to save money as a student.no 4 is simply genius.

2. Create a strong and diverse investment portfolio

There is no one way to go about this. Some people would feel comfortable with stocks, bonds, real estate, hedge funds, forex, or crypto, and these are just the ones I can think of right off the bat.

If you can carry out very detailed and deep research into different investment ventures, understand how they function, their pros and cons, and the level of risk associated with each of them.

After you have carried out this thorough research and shortlisted the ones that you think you understand the concept (note that you are still an amateur if you are new to it and should proceed with caution) then you can go ahead and fix all of them into a safe investment portfolio.

Also, determine your risk tolerance and the amount of loss you can handle. Also discover how the investments you make can affect your emotion because you can’t make the right decisions, especially in a volatile market if you get emotional in the swing in the market

You can contact us to find out ways to build a strong portfolio.

3. Research Refinancing Options

If you have student loans with a high interest rate, refinancing may allow you to pay them off faster. Switching to a new lender that offers a lower interest rate or better terms is what refinancing your student loans entails.

You can use a refinancing calculator to see how much money you could save by refinancing. Assume you have a $40,000 loan with a 10-year term and a 7% interest rate. The monthly installment is $465.

If you refinance to a 7-year term at 4% interest, your new monthly payment will be around $545, an increase of $80. You will, however, pay off your student’s loan three years sooner and save a whopping $9,800 in interest.

There is a disadvantage to refinancing, particularly if you have federal loans. When you refinance federal loans, they become private loans and lose all of the benefits that come with federal loans, such as income-driven repayment plans, longer deferment and forbearance periods, and loan forgiveness programs.

In addition, since the Covid-19 pandemic began, the government has suspended federal student loan payments and set interest rates at 0%. This same provision does not apply to private loans.

If you have a mix of federal and private loans, you could refinance the private loans to a lower interest rate while keeping the federal loans in place. This could give you the best of both worlds.

So, with that, I rest my case. But, seriously, I believe I have covered enough ground in this article to help you pay off or reduce your loan. You can contact me at Grace@birizon.com for free assistance with the process.

Have a beautiful week.

Grace moran

Grace moran