In this article, I will be covering everything there is to know about the Ethereum merger also called “the merge” and some tips on what to do with this information.

First tip; Google "Ethereum Merge," and you'll see a nice countdown clock with two pandas, one black and one white, approaching each other slowly. When the clock strikes zero on September 14 or 15, the two pandas will become one. This exciting metaphor elevates the Ethereum Merge's significance to everyone, not just cryptocurrency enthusiasts.

A brief history

Ethereum has a long and storied history, with many developments and incidents to mark both significant positive changes and setbacks.

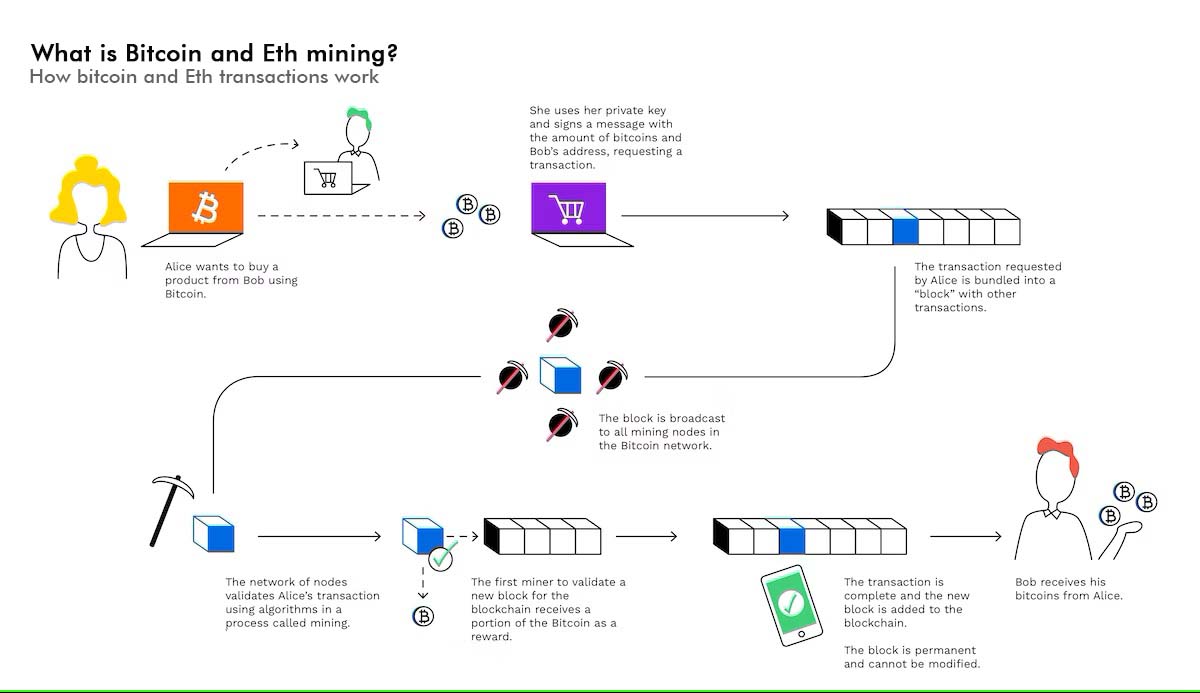

The most important upcoming change is a shift from the proof-of-work (PoW) to the proof-of-stake (PoS) model, which aims to improve the security and scalability of the blockchain network.

For Ethereum to process and create a new coin, it requires enormous energy that currently emits roughly the same amount of carbon dioxide as Singapore.

If the Merge is successful, it will reduce ethereum's massive electricity requirements by more than 99% or at least that is what is theorized

How is crypto bad for the environment?

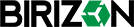

Before we can dive into the merge, you need to understand the work of cryptocurrency miners.

Assume you desired to mine cryptocurrency. You'd set up a powerful computer, known as a "mining rig," to run software that tries to solve complex cryptographic puzzles. Your rig is up against hundreds of thousands of miners all over the world who are attempting to solve the same puzzle.

If your computer is the first to decrypt the cryptography, you win the right to "validate" a block, or add new data to the blockchain. You will be rewarded for doing so: Bitcoin miners receive 6.25 bitcoin for each block they verify, whereas Ethereum miners receive 2 ether plus gas, which are transaction fees paid by users, in most cases can be huge.

Only powerful computers can have a chance a win the right, it is normal to find people who have set up warehouses filled with rigs for this purpose. This system is called “proof of work” and that’s what bitcoin and Ethereum use.

All of these means that the energy required is very high, which made miners become smart and find other cheaper means of mining. Because renewable energy sources are less expensive, the majority of that energy is derived from them, and mining operations are frequently located near wind, solar, or hydro farms.

According to the Bitcoin Mining Council, 57% of the energy used to mine bitcoin comes from renewable sources(The BMC relies on member self-reporting.), because renewable energy is inexpensive, mining operations are frequently located near wind, solar, or hydro farms.

Nonetheless, the carbon footprint is substantial.

What is the Ethereum merge?

The Merge represents the union of Ethereum's existing execution layer (the Mainnet as we know it today) and its new proof-of-stake consensus layer, the Beacon Chain. The Beacon Chain is a ledger of accounts that governs and coordinates the stakeholder network.

It is not the same as the Ethereum Mainnet of today. It does not handle smart contract interactions or transactions. Read more about it here.

It does away with the need for energy-intensive mining in favor of securing the network with staked ETH. A truly exciting step toward realizing the Ethereum vision - increased scalability, security, and sustainability.

Take this as an example, let’s take Ethereum as a ship that isn’t quite ready for the pacific, now the community has built a stronger engine with tougher materials to handle the waves.

After several test runs, it's almost time to change from the old engine to the new and improved engine. This will merge the new, more efficient engine into the existing ship, ready to put in some serious speed and agility and take to the deep sea.

The changes are part of "Ethereum 2.0," an umbrella term for Ethereum's next evolution into a better-performing, more accessible network. Sharding is also included in the upgrade, which allows transactions to be processed concurrently across smaller chains, resulting in faster transaction speeds.

The following factors are driving the shift to a Proof-of-Stake consensus mechanism:

- Decentralization is increased by lowering the hardware requirements for node operators.

- Transaction confirmations are completed faster (though overall speed will be about the same)

- Energy consumption by node validators is reduced by 99% or more.

- Capability to add additional scaling solutions (such as sharding)

- Increased security as a result of client diversity

- Make Ethereum a deflationary asset.

How will this eth merge work?

Don’t forget, the merge will completely eliminate the proof of work for the proof of stake.

Staking means the depositing of cryptocurrency to a protocol.

Miners will no longer need to solve cryptographic puzzles to verify new blocks once proof of stake is implemented. They will instead deposit ether tokens into a pool. Consider each of these tokens to be a lottery ticket: If your token number is called, you will be given the opportunity to verify the next block and earn the associated rewards.

It is still an expensive venture. Prospective block verifiers, who will be referred to as "validators" rather than miners, must stake a minimum of 32 ether ($48,500) to be eligible. To validate blocks in this system, punters must put up raw capital rather than power.

The Ethereum Foundation estimates that the system's electricity consumption will decrease by 99.65% as a result of the removal of cryptographic puzzles.

Can I stake with little money?

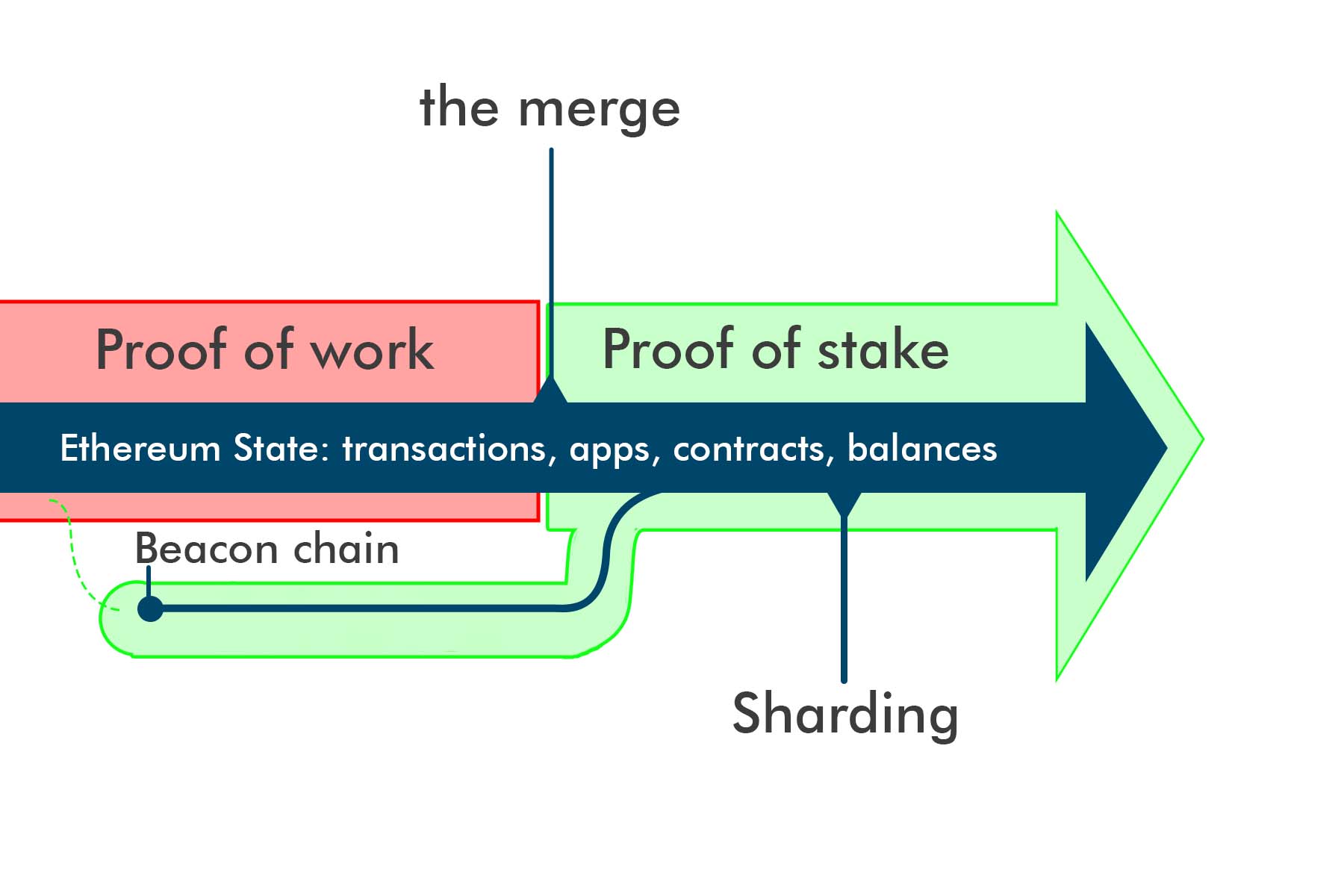

Those who do not have 32 Ether or do not want to run a validator node but still want to stake Ether can do so by joining a staking pool. A staking pool combines multiple individuals' deposits to stake the required 32 ETH for an Ethereum validator node.

The block rewards from that node are then distributed to the staking pool in proportion to the amount of ETH deposited per individual account.

A version of this is also available on cryptocurrency exchanges such as Birizon, which allows users to stake small amounts in exchange for a fixed reward amount.

What is the new reward for mining ETH?

The amount of Ethereum issued as block rewards will also be reduced significantly. Currently, approximately 13,000 Ether are mined per day. After the merger, that number will fall to around 1,600 Ether per day. This represents a 90% reduction in Ether issues, slowing Ether's inflationary growth.

Risk involved with the merging

There are several number of risks involved because the network will be vulnerable to attack when it is transitioning to the new network like:

Scams

The merged and upgraded network has been referred to as "ETH 2" by many crypto applications. This has caused speculation about the existence of a new cryptocurrency known as ETH 2. (There is not). Don't let anyone convince you that you must switch to Eth2. Anyone who offers to do this is a swindler.

Read more about this below “what should I do to prepare?”.

Centralization of Staked ETH

It's no surprise that staking pools have grown in popularity recently, given that you need 32 people to stake. However, there is a disadvantage to centralizing the staking pools: it increases the risk of censorship and governance takeover.

Denial-of-Service (DoS) Attack Vulnerability

With the adoption of PoS, network proposers will be known in advance, making them vulnerable to DoS attacks. For example, if a potential attacker is in line to propose one of the next blocks in the blockchain, they can try to DoS (a sophisticated networking attack) the current proposer's node, causing them to lose their slot and allowing the attacker to pick up the transactions in that slot. There are solutions being developed to make the proposer selection anonymous, but this remains a risk for the time being.

What should I do to prepare?

The Merge is one of the most significant and anticipated upgrades in Ethereum history, and while its impact will be felt by everyone in the long run, some people will need to take action in the short term to be fully prepared.

Holders and users

You do not need to do anything to safeguard your funds as they enter The Merge.

This needs to be stated again: As a user or holder of ETH or any other digital asset on Ethereum, as well as non-node-operating stakers, you are not required to do anything with your funds or wallet prior to The Merge.

Despite the switch from proof-of-work to proof-of-stake, Ethereum's entire history since its inception remains intact and unaltered. Any funds in your wallet prior to The Merge will remain accessible after The Merge. You do not need to take any action to upgrade.

As the Ethereum Mainnet Merge approaches, you should be on the lookout for scams attempting to take advantage of users during this transition. Do not send your ETH anywhere in the hopes of "upgrading to ETH2." There is no "ETH2" token, and there is nothing else you need to do to keep your funds secure.

How will it affect the price of ether?

Ether is down about 55% since the beginning of the year, and many people are hoping that the Merge will bring it back up. This has been a hotly debated topic in crypto circles in recent months, and no one knows for certain how the Merge will affect the price of ether.

The straightforward and honest truth is that no one can accurately predict what will happen because it is a brand-new phenomenon.

What happened to 'Eth2'?

The term 'Eth2' has been deprecated as we approach The Merge.

There will no longer be two distinct Ethereum networks after merging 'Eth1' and 'Eth2' into a single chain; there will only be Ethereum.

To limit confusion, the community has updated these terms:

'Eth1' is now the 'execution layer', which handles transactions and execution.

'Eth2' is now the 'consensus layer', which handles proof-of-stake consensus.

These terminology updates only change naming conventions; this does not alter Ethereum's goals or roadmap.

So, if you found this guide useful, please share your thoughts in the comment section below and sign up for our newsletter, we send out weekly articles on a variety of topics.

Paul Maxison

Paul Maxison